Investment Strategies

Aligned with the Evidence, Designed to be Understood

Investors need three things from investment strategies:

- Growth, or the ability to compound their money,

- Income, otherwise known as “yield,” and

- Diversification, or a way to manage risk.

And whether the investor in question is a gigantic institution or the world’s most specific person, their portfolio can be intuitively understood as a blend of those three purposes.

Or rather, it could be, if its pieces were designed to be understood. Unfortunately it often takes a master’s degree, some very expensive data, and a week or so to arrive at such an understanding.

By contrast, our strategies are built to be known. After a few hours with them and your favorite search engine, you’ll know what you own. And if you look at how they’re labeled, you’ll know why.

I hope what we do is useful to you. Sending good vibes your way from Utah –

Sloane

Three Strategies, One Process

📈 Growth Strategy

Long-term growth through 15-25 concentrated positions in exceptional companies.

- 15-25 individual stocks (top 5 positions are commonly >50% of the portfolio)

- Direct equity ownership for maximum impact

- Full ethical screening with no compromises

Our flagship strategy invests in businesses that generate positive impact as an inherent result of their business activity. It is built from the bottom up based purely on our research. This means its composition is generally 97-98% different from the indices that investors are used to.

The strategy seeks long-term growth and capital appreciation by purchasing shares of companies we’d like to own forever, and continuously refining our portfolio of them.

View Growth Strategy Fact Sheet →

💰 Income Strategy

Current income and portfolio stability

Income generation with capital preservation through opportunistic investments in companies and funds.

- 5-15 holdings (income-producing securities)

- Lower volatility than growth strategy

This holding is suitable for clients with shorter-term objectives, such as 1-3 year goals, or for those in the drawdown phase of retirement who need to generate income. It invests in a curated combination of high-quality income-generating assets, including bonds, preferred stocks, closed-end funds, and other income-producing securities.

While the Growth strategy has a possible investment universe of 2,500 companies, the Income strategy operates in a more constrained universe of roughly 250-500 securities. Accordingly, we may choose to implement its mandate through external funds that align with (but do not necessarily replicate) our ethical grounding.

View Income Strategy Fact Sheet →

⚖️ Diversification Strategy

For Sequence of Returns Risk or Market Jitters

Balanced returns through carefully selected funds that complement our growth strategy.

- 5-15 diversified funds across equity, fixed income, and alternatives

- Opportunistic construction across markets, strategies, and sectors

- Ethical screening for all fund selections

This strategy is an opportunistic complement to our growth strategy. It can be used as a tool for aligning quarter-on-quarter performance with a desired index, thereby reducing “tracking error” (the difference between a portfolio’s performance and its benchmark) as well as reliance on our stockpicking skill.

The Diversification strategy is generally implemented entirely through external managers who align with (but don’t necessarily replicate) our approach to ethical screening. This approach allows us to access certain opportunities that are not accessible in our growth strategy, given that it is only able to trade domestically listed stocks and ADRs.

Combining Strategies

Our strategies are composable - you can blend them in any proportion that suits your timeline and risk tolerance.

How Blends Work:

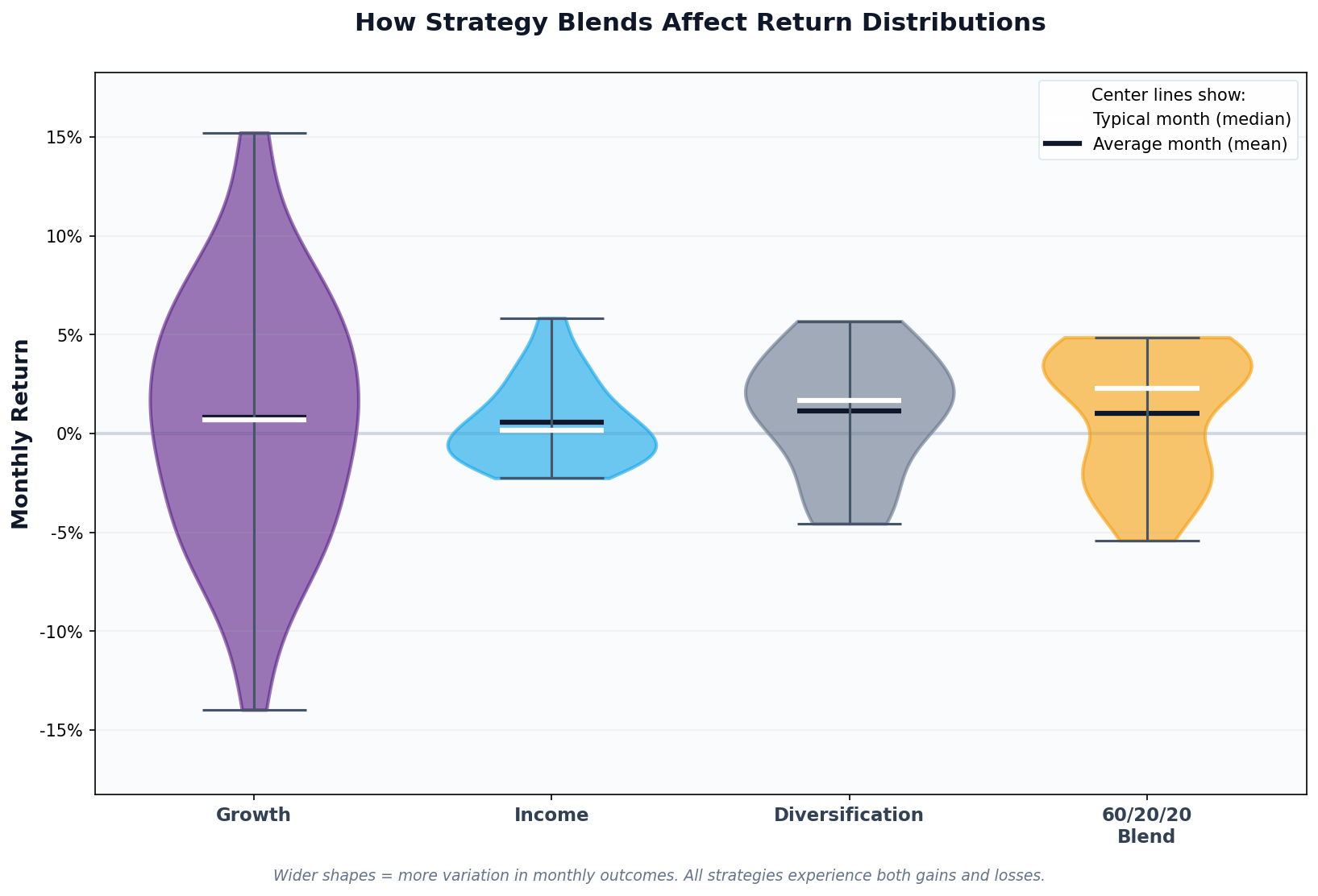

The chart above shows the full range of monthly returns for each strategy, plus a 60/20/20 blend. Notice how composition affects both typical outcomes and the spread of variation - blending tends to narrow the range while maintaining upside potential.

We maintain standard blends for common objectives, but custom allocations are straightforward:

- Your timeline: How long until you need the money?

- Risk tolerance: What range of outcomes can you live with?

- Income needs: Do you need cash flow now or later?

- Concentration comfort: How do you feel about concentrated positions?

Advisers using our SMAs via the Schwab platform have this same flexibility.

Getting Started

1. Discovery Call - We’ll discuss your goals, values, and time horizon (30-45 minutes)

2. Implementation - We handle all paperwork and begin your strategy (1-2 weeks)

Schedule Strategy Call | Learn About Our Process

Investment strategies involve risk of loss. Past performance does not guarantee future results.

Invest Vegan LLC DBA Ethical Capital is a registered investment adviser. This website is for informational purposes only and does not constitute investment advice.