What We Own Right Now and Why

We work hard to identify and invest in companies that generate positive real-world impact in the same way they generate revenue.

This isn’t just about feeling good. For one thing, we consider companies with a positive, well-established role in a broader system to be more resilient than their competitors. They tend to be good stewards of their corporate assets, with well-established governance procedures and clear processes to mitigate conflicts with shareholders.

With that said, companies are social organisms with living, breathing components. Which makes it difficult to capture what makes them special with mere statistics. Fortunately, concentration is one of the hallmarks of our investment style. Which means it’s possible for us to pull together brief narratives about our holdings which you can read through at your leisure.

This approach differs significantly from the way investment firms typically talk about impact.

The tendency is to produce reports which focus on a handful of issues like climate, waste, and water usage. But unfortunately, this can prevent clients and other stakeholders from developing a holistic view of how the portfolio’s holdings interact with the world around them. This conventional approach can also focus your attention on data that is easily comparable and readily available, which overlooks much of the nuance of a deeper analysis.

Our approach has downsides too. It’s more unwieldy than a slick infographic, short on portfolio-level statistics, and long on my own exposition. We are always looking to refine and improve our approach to this, so I hope you’ll share your thoughts with us on how we can do better.

How We Pick Our Holdings

Before getting into the narrative description of our current holdings, let me provide some more background about our approach.

The chart below shows how we currently allocate our assets:

As you’ll see, our current portfolio is relatively concentrated in four different verticals: Infrastructure, Innovation, Lending, and Real Estate. We settled on this approach through an iterative process that started with the recognition that building a portfolio predicated on direct impact was not, fundamentally, a screening problem.

We don’t think of our job as finding the best companies within some predefined universe. We start instead with a clear sense of what issues we think are most significant, and then design our portfolio to allocate capital toward solutions for those issues. You can learn more about this approach in our investment process overview and explore our individual investment strategies for specific portfolio objectives.

Here are the issues we’ve focused on, along with the rationale for picking each one:

Financial Stability: Everyone needs access to banking and credit at reasonable rates. But the firms that specialize in this tend to get caught up in the pursuit of extraordinary profits from fees and complex products. We prefer to invest in companies that help to democratize access to credit.

Housing: Just about everyone needs a place to live, and it’s incredibly difficult to participate effectively in society when you can’t be sure where you’ll be sleeping from one night to the next. Unfortunately, much of the housing stock that gets built now is unaffordable for most people and often unnecessary.

Health: High-quality healthcare shouldn’t be a luxury good. But the American healthcare system often extracts money from the people who can least afford it without creating much value in the process. We would prefer our investments to contribute to care, rather than complexity.

Learning: The people best positioned to navigate an economy of constant change are likely those who can learn and adapt quickly. And investments in the quality of our educational system are likely to pay dividends for decades to come.

Food: The agriculture we engage in right now is not sustainable in the long run, but it also appears to be organized around creating the highest possible yields rather than the highest possible quality.

What We Own and Why We Own It

With that context in mind, here are descriptions of our current holdings:

Agricultural Mortgage Corporation (AGM)

Infrastructure/Lending

Agricultural Mortgage Corporation is a government-sponsored enterprise that provides credit to rural America through the secondary market for agricultural real estate mortgages and USDA-guaranteed farm loans.

Think of them as the Fannie Mae of farming: they purchase loans from agricultural lenders, which enables those lenders to make more loans to farmers. This makes credit more available and less expensive for agricultural borrowers.

We like AGM because:

- Rural America needs capital: Small farms and rural communities often struggle to access affordable credit

- Food security matters: Supporting agricultural infrastructure supports domestic food production

- Proven model: The GSE structure has worked well for housing finance

- Steady returns: AGM provides consistent dividend income with reasonable growth prospects

This investment supports sustainable agriculture financing while providing our clients with stable income.

Alexandria Real Estate Equities (ARE)

Real Estate

Alexandria Real Estate is the largest and longest-tenured life science REIT, providing laboratory and office space to innovative life science companies worldwide.

ARE owns and develops properties specifically designed for life science research - specialized laboratory spaces that biotech and pharmaceutical companies need to develop new treatments and cures.

We own ARE because:

- Health innovation infrastructure: They provide the physical foundation for medical breakthroughs

- High barriers to entry: Specialized lab space is difficult to replicate

- Quality tenants: Their tenants are typically well-funded research institutions and biotech companies

- Growing demand: The life sciences sector continues to expand globally

This holding supports the infrastructure needed for medical innovation while providing exposure to real estate.

Duolingo (DUOL)

Innovation/Learning

Duolingo makes language learning accessible to anyone with a smartphone through their gamified language learning platform.

With over 500 million registered users worldwide, Duolingo democratizes access to language education through free and premium offerings.

We invest in Duolingo because:

- Education access: They make language learning available to people regardless of economic status

- Real impact: Millions of people use their platform daily to develop new skills

- Network effects: More users create better content and stronger engagement

- International growth: Expanding into new languages and markets globally

This position reflects our belief that education technology can break down barriers and create opportunities.

Lemonade (LMND)

Innovation/Insurance

Lemonade is transforming insurance through technology and social impact, offering renters, homeowners, and pet insurance with a focus on speed, transparency, and giving back.

Lemonade operates on a “Giveback” model where unclaimed premiums are donated to causes chosen by policyholders, aligning customer and company interests.

We own Lemonade because:

- Insurance innovation: They’re modernizing an industry that has resisted change

- Social mission: Their giveback model creates positive social impact

- Technology advantage: AI and automation create efficiency and better customer experience

- Young demographics: They’re capturing younger customers who value transparency and social impact

This investment supports innovation in financial services while promoting corporate social responsibility.

Crocs (CROX)

Innovation/Consumer

Crocs designs, manufactures, and markets foam clogs and other casual footwear known for comfort, durability, and distinctive style.

While perhaps an unconventional choice for an ethical portfolio, Crocs demonstrates several compelling sustainability and business characteristics.

We include Crocs because:

- Durability reduces waste: Their shoes last significantly longer than typical footwear

- Material innovation: They’re developing more sustainable materials and manufacturing processes

- Global accessibility: Affordable, practical footwear available worldwide

- Strong brand loyalty: Customers are passionate advocates, creating sustainable demand

This holding represents our view that sometimes sustainable business practices come from unexpected places.

Portfolio Construction Principles

Our approach to building this portfolio reflects several key principles:

Concentration Over Diversification

We believe it’s better to own fewer companies that we understand deeply rather than many companies we understand superficially. This concentration allows us to:

- Conduct thorough due diligence on each holding

- Monitor developments that could affect our investment thesis

- Engage meaningfully with management teams when appropriate

- Make more informed decisions about position sizing

Impact Through Revenue, Not Just Values

We focus on companies that create positive impact through their core business model, not just through corporate social responsibility programs. This means:

- The positive impact scales with business success

- Impact is sustainable even during difficult periods

- Management incentives align with social outcomes

- Our returns correlate with positive real-world outcomes

Sector Agnostic, Theme Focused

Rather than limiting ourselves to particular industries, we focus on themes that matter for long-term social and economic development:

- Infrastructure that enables progress

- Innovation that solves real problems

- Financial services that promote stability

- Real estate that serves genuine needs

This approach allows us to find opportunity across different sectors while maintaining focus on our core themes.

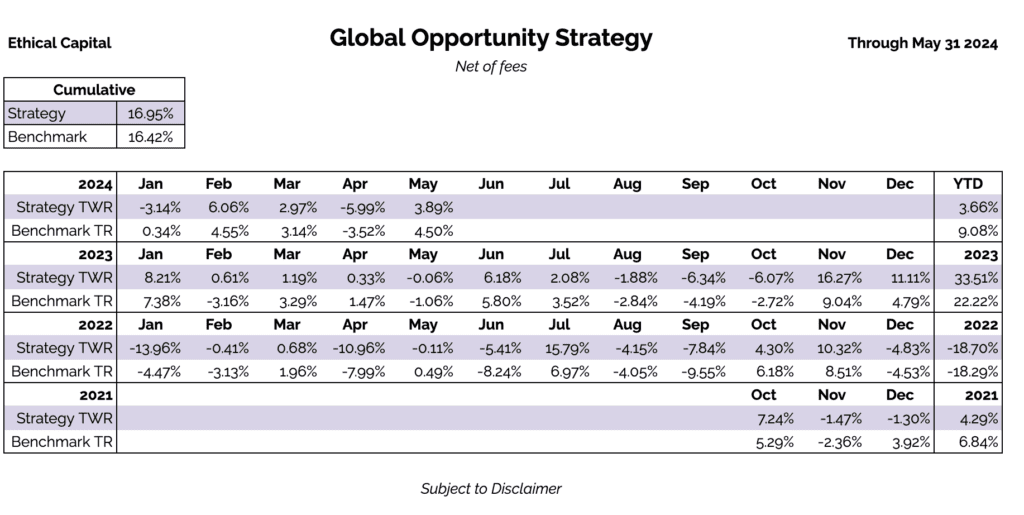

Performance Context

Our concentrated approach inevitably creates different risk and return characteristics than broadly diversified portfolios:

- Higher volatility: Fewer holdings mean individual company performance matters more

- Different sector exposure: Our thematic focus creates unique sector weightings

- Active management: We make decisions based on changing conditions and opportunities

- Long-term orientation: We’re willing to accept short-term volatility for long-term alignment

This approach isn’t right for everyone, but it reflects our view that values-aligned investing requires active engagement and careful selection.

Looking Forward

Our holdings evolve as we identify new opportunities and as existing holdings develop. We expect this portfolio to change over time as:

- New companies emerge that fit our investment criteria

- Existing holdings grow and change their business focus

- Market conditions create new opportunities or challenges

- Our understanding of important themes develops

We’ll continue to provide transparent updates on our holdings and the reasoning behind our investment decisions.

This analysis reflects our current holdings as of the publication date. Holdings may change without notice. For current portfolio information, please contact us directly.

Want to learn more about our investment approach? Schedule a consultation or explore our investment philosophy for deeper insights into our methodology.